Image

Realtor.com

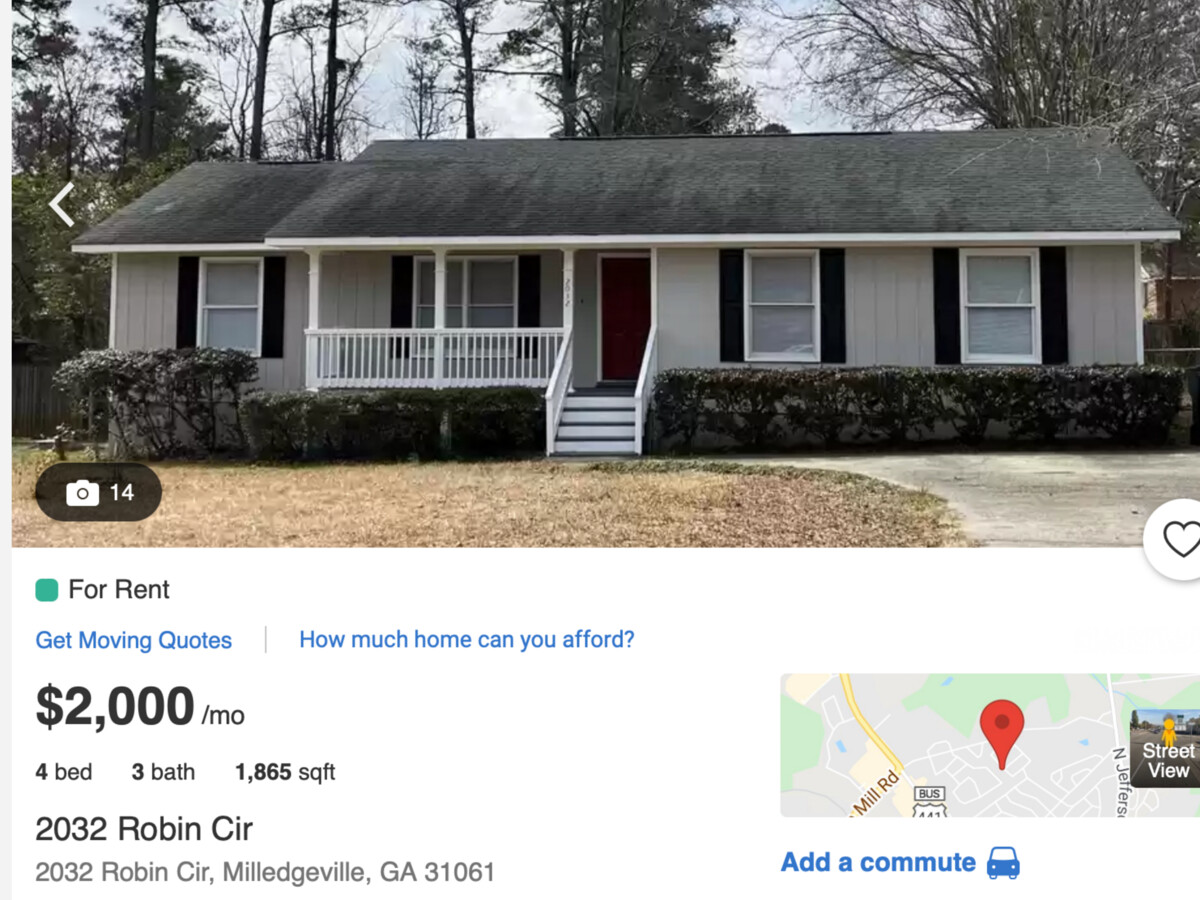

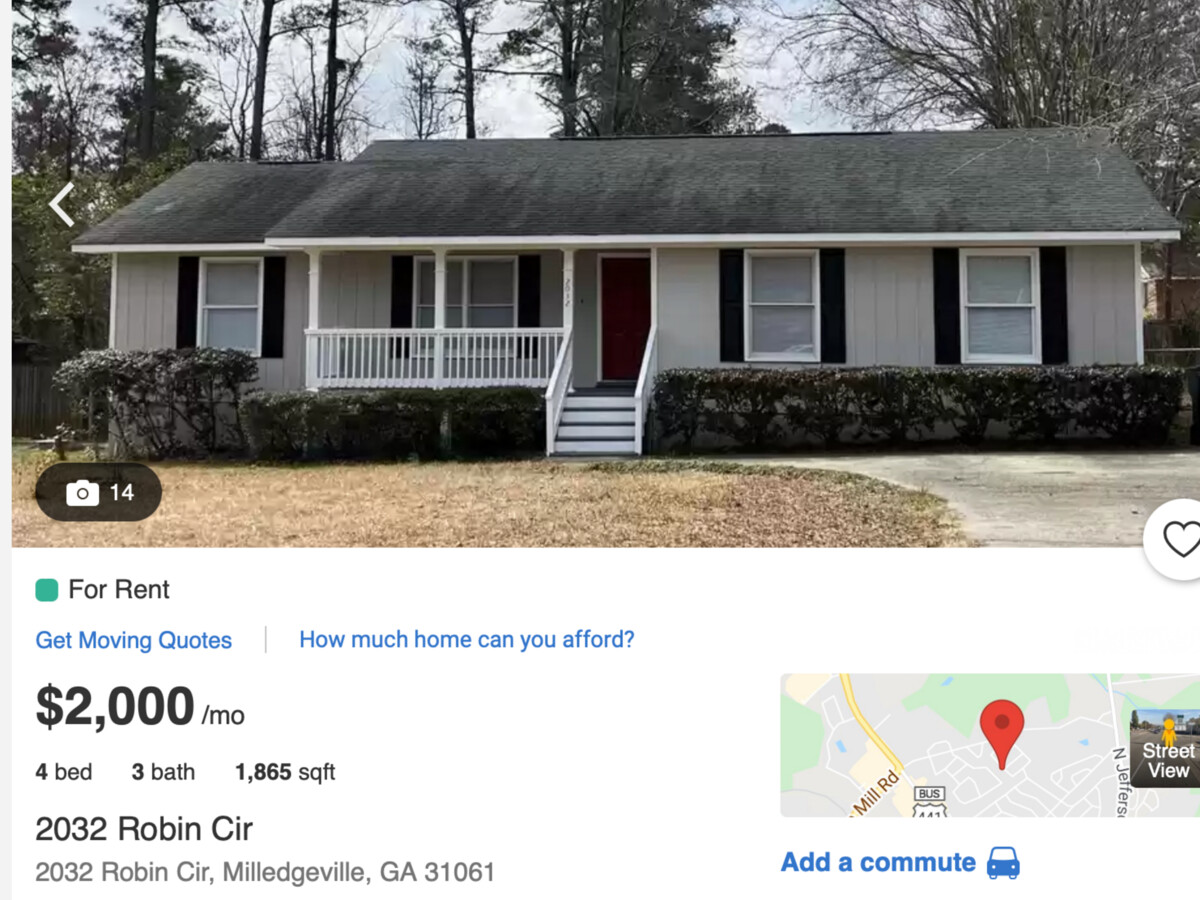

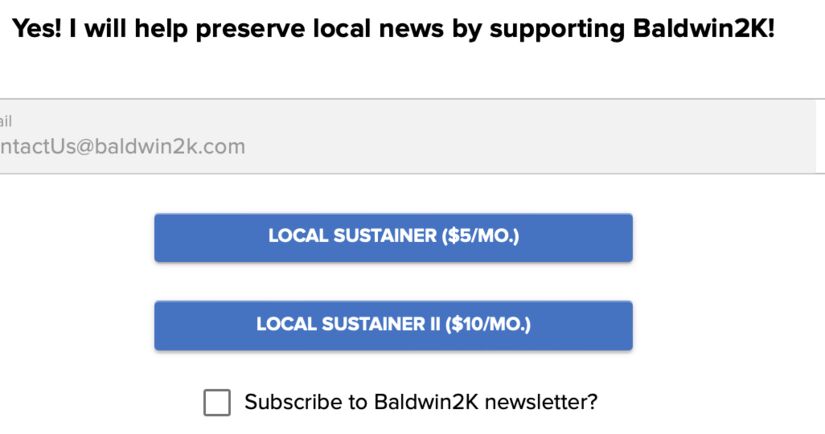

An 1,865-square foot rental house on Robin Circle in Carrington Woods recently was listed online for $2,000 per month.

The back porch of the home offers several stunning and picturesque views of Leo Court.

Realtor.com

Two thousand dollars a month, of course, adds up to $24,000 per year, which is nearly as much as the yearly per capita income in Baldwin County ($26,934), according to the most recent Census data.

Several months ago, meanwhile, a mobile home on Harrisburg Road was advertised online at $900 per month.

ApartmentFinder.com

Louise Sallstrom, currently the executive director of Milledgeville Cares, has been volunteering around Milledgeville for more than 30 years.

"Housing is the worst problem we have in Milledgevlle. It's awful," she said. "When you have Georgia College students willing to pay upwards of $1,000 for a bedroom, which is happening now in some cases, there will be a trickle down effect."

Wanda Addeo is the executive director of Overview Inc. and is on the front lines of the runaway rent situation.

"I have been here for 13 years, and I've never seen it this bad. It's a pretty big issue right now, especially for lower income families," said Addeo, adding that her organization recently was awarded with an emergency federal grant to help with rental assistance.

As of July 1, 2019, according to the Census, there were 20,725 "housing units" in Baldwin County, a combination of single family homes and apartments, according to the Census. The "owner-occupied" rate, meanwhile, was 59.4 percent, meaning that 40.6 percent of residents of Baldwin County were "renters," compared to a statewide average of 36 percent. In other words, Milledgeville-Baldwin County is more of a "rental town" compared to the statewide average. This can be seen in other college towns, as well. In Athens-Clarke County, for example, a whopping 59.5 percent of residents are renters, according to the most recent Census data.

However, that doesn't fully explain the problem, and it doesn't fully explain the more recent surge in rental prices. After all, Georgia College has has been around for more than 100 years, and it hasn't gotten any bigger lately. The in-person enrollment at the university has remained steady at somewhere between 5,500-6,000 students for the last several decades.

Also, surging rental prices is hardly a Milledgeville issue. Rent in some major markets rose by more than 33 percent between January 2021 and January 2022, according to an article in the Washington Post, including Austin, Tex., which saw a year-over-year increase of 40 percent.

So, why is rent so high? Baldwin2k News won't pretend to play market analyst, but here are some links to some other articles that offer some theories:

• Washington Post // Jan. 30, 2022 – (EXCERPT) "The pandemic has exacerbated inequalities in many parts of life, and housing is no different. Homeowners benefited from rock-bottom interest rates and surging home prices, while renters have faced surging costs with little reprieve. And unlike markups in other categories — such as food or gas, where prices can waver in both directions — economists say annual leases and long-term mortgages make it unlikely that housing costs will come back down quickly once they rise."

• Fidelity // Jan. 14, 2022 – (EXCERPT) "Low vacancies, exorbitant home sale prices, inflated construction costs, and the demand for amenity-filled homes are fueling rent increases."

•Georgia Public Broadcasting // Feb. 14, 2022 – (EXCERPT) "The root cause of the problem is a lack of supply," (Redfin's Chief Economist Daryl) Fairweather says. "We have not built enough homes to meet demand." There a bunch of reasons for that. One of the biggest, she says, is restrictive zoning. Especially in higher-cost parts of the country, zoning rules make it hard to build cheaper smaller houses or apartments that are tightly packed together.

• U.S. News & World Report // Feb. 20, 2022 – (EXCERPT) "Meanwhile, the number of homes for sale have been at a record low, contributing to ballooning home prices that have caused many higher-income households to remain renters, further upping demand. Construction crews are also trying to bounce back from material and labor shortages that at the start of the pandemic made a preexisting shortage of new homes even worse, leaving an estimated shortfall of 5.8 million single-family homes, a 51% leap from the end of 2019, Realtor.com said.

• New York Times // March 7, 2022 – (EXCERPT) "For years many cities have not built enough housing to keep up with population and job growth. That was exacerbated during the pandemic, as supply chain snags and labor constraints further slowed construction. But more people also want homes. Many young people in their 20s and 30s are increasingly seeking their own places to live, Mr. Salviati said, after delaying those decisions during the height of the pandemic. The spiraling cost of homeownership has had a cascading impact on the rental market. With the appetite for single-family homes and condominiums driving up their cost, some people eager to buy are instead opting to rent, pushing up rental prices."

^^^Check out this video from one of our COMMUNITY SUSTAINERS, or CLICK HERE for more about the business!!!